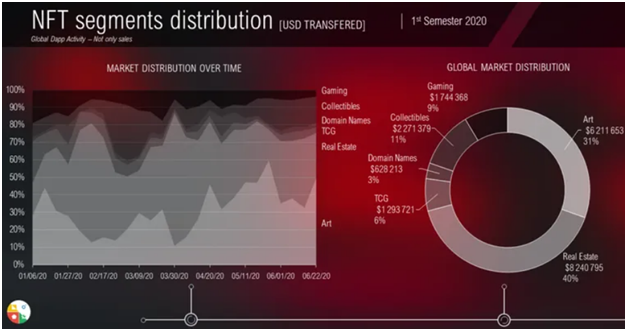

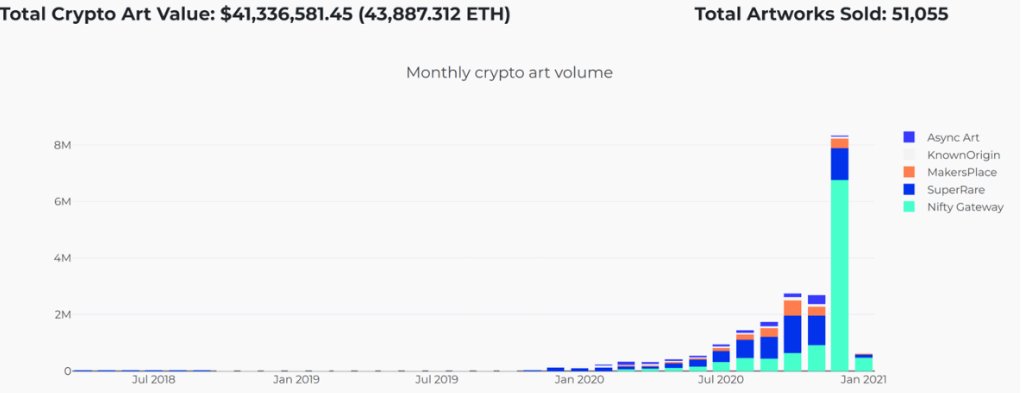

The NFT market has blossomed in 2020. The first half of the year seen a 294.29% rise cumulative turnover to $232.5 million, in comparison to the first half of 2019. The market leader was land in the virtual worlds space taking 40% of the turnover. This was closely followed by the ever-growing tokenised art sector at 31%.

The second half of 2020 was spearheaded by the rise of Decentralised Finance (DeFi). Notable mentions include one of the largest NFT collections held by “Whale Shark”, being backed by social cryptocurrency token $WHALE, continued to rise. A memorable moment was the auction of “Block 21” a tokenised painting selling for 10 times higher than previous estimates.

The total turnover of the NFT market is a considerable way behind the cryptocurrency market in these early stages, though it is not surprising to see it outperform the likes of Bitcoin in percentage terms of growth in 2020 (185% growth). In December 2020, the NFT market saw user growth increase by 155%, with the 30-day trading volume reach over $10 million.

Since the start of 2020, an increase of 214% in new users have entered the NFT market. This rise was mostly in the NFT Art and NFT Gaming Sectors, which was a combined total of around $100million. There are over 70 NFT companies operating at present, though this figure is growing all the time.

This year, the two biggest sectors within the NFT industry have been art and gaming. NFT artist “Beeple” was responsible for driving the largest art sale in NFT history, with $3.5 million worth of art sold in a single 24-hour auction this month.

The NFT Gaming sector was the second major contributor to the growth of the NFT industry in 2020. Blockchain-based games had a meteoric rise and projects such as Axie Infinity recorded $1.8 million in trading volume in December 2020 alone. It’s on-chain user-base grew by an impressive 3063% in 2020 and the platform recorded high profile trades worth $83,000 and $134,000.

The NFT Gaming sector was the second major contributor to the growth of the NFT industry in 2020. Blockchain-based games had a meteoric rise and projects such as Axie Infinity recorded $1.8 million in trading volume in December 2020 alone. It’s on-chain user-base grew by an impressive 3063% in 2020 and the platform recorded high profile trades worth $83,000 and $134,000.

The Covid 19 pandemic could have actually assisted the growth in the NFT space, particularly the gaming sector, as the time spent gaming rose by 51% to 6.8 hours per week in the US. In-game expenditure hit a staggering $11.6 billion in April – June 2020. A similar notion applies to digital art, as physical art galleries have closed, with their sales dropping by as much as 36% in 2020.

The world’s largest institutions have definitely noticed such trends. In December 2020, Microsoft and Big Four firm Ernst & Young announced the expansion of Microsoft’s blockchain-based solution in extending gaming rights and royalties via NFT-based tokenisation mechanisms.

The NFT market looks primed to continue its expansion in 2021, with crypto analytics company Interdax, forecasting that the NFT market potentially reaching $1 billion by the end of 2021.